Exploring the Implications of the US Debt Ceiling Debate

Exploring the Implications of the US Debt Ceiling Debate: Latest Updates and Potential Consequences

Introduction:

The US debt ceiling debate has once again taken center stage, capturing the attention of policymakers, economists, and citizens alike. As the United States faces a critical decision on whether to raise its debt limit, the implications of this ongoing discussion have significant ramifications for the country’s financial stability and global standing. In this article, we delve into the latest updates surrounding the US debt ceiling and shed light on the potential consequences it could have on various sectors.

-

Understanding the US Debt Ceiling:

The US debt ceiling is a statutory limit set by Congress on the total amount of money the federal government can borrow to meet its financial obligations. Currently, the debt ceiling stands at $28.9 trillion, an amount that has been reached due to the accumulation of previous budget deficits. Failure to raise the debt ceiling could result in a default on the country’s financial obligations, leading to severe consequences for the US economy and its citizens.

-

Latest Updates on the US Debt Ceiling Debate:

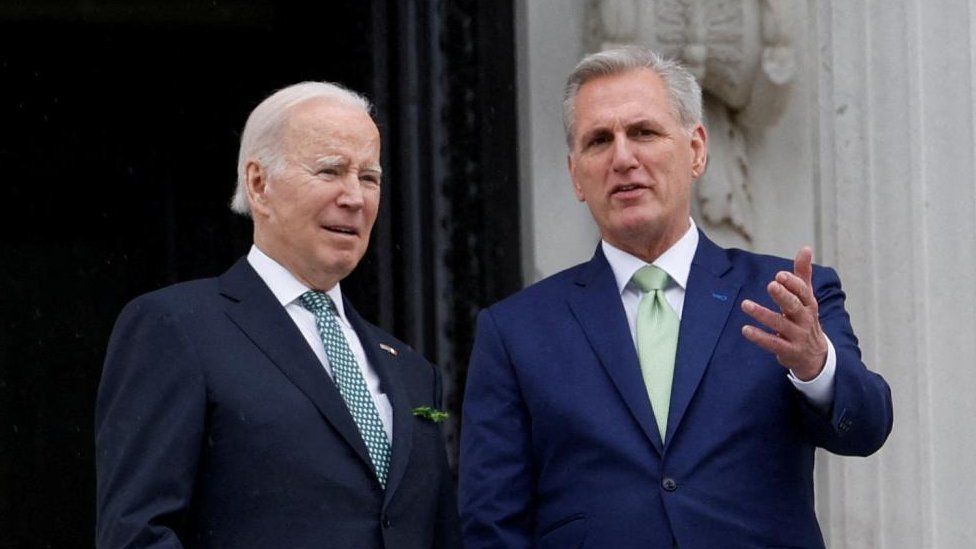

The United States has been grappling with the need to raise the debt ceiling to avoid defaulting on its debts. As of the latest updates, Congress is engaged in heated discussions on whether to increase the debt limit. Failure to reach a consensus could potentially lead to a government shutdown, disruption of federal services, and a downgrade in the country’s credit rating.

-

Potential Consequences of Failing to Raise the Debt Ceiling:

a. Economic Uncertainty: Failing to raise the debt ceiling could result in significant economic uncertainty, as it would create doubts about the US government’s ability to meet its financial obligations. This uncertainty could lead to a decrease in investor confidence, increased borrowing costs, and a negative impact on the stock market.

b. Impact on Government Programs: A failure to raise the debt ceiling may force the government to prioritize its spending, potentially leading to cuts in critical programs such as healthcare, education, and defense. This could have far-reaching implications for citizens who rely on these services.

c. Global Ramifications: The US dollar serves as the world’s reserve currency, and any instability in the US economy could have ripple effects worldwide. A failure to raise the debt ceiling could undermine the global perception of the US as a reliable economic powerhouse, potentially triggering market volatility and affecting international trade.

Read more about CarynAI Clone: Caryn Marjorie The First Person To Do Using AI

-

Potential Solutions and Mitigation Strategies:

To address the US debt ceiling issue, policymakers have several potential solutions at their disposal. These include raising the debt limit, reducing government spending, increasing revenues, or a combination of these measures. Additionally, the Treasury Department can employ extraordinary measures, such as suspending certain investments or borrowing from other accounts, to temporarily mitigate the consequences of hitting the debt ceiling.

Conclusion:

The US debt ceiling debate holds significant implications for the country’s economic stability, government programs, and global standing. The ongoing discussions in Congress regarding whether to raise the debt limit are critical to determining the path forward.

As the deadline approaches, the potential consequences of failing to raise the debt ceiling become increasingly concerning. It is crucial for policymakers to find a solution that ensures the financial integrity of the United States while considering the long-term implications for the economy and its citizens.